Decarbonising Commercial Property

COP27‘s international participants had a stern warning ringing between their ears: that the world has little to no chance of delivering the Paris Agreement’s target of limiting global warming to 1.5 degrees Celsius compared to pre-industrial levels.

How far are we away? This paragraph from the New Scientist beautifully summarises just how far we’re missing the target:

“The plans countries have drawn up would see carbon emissions fall by 3.6 per cent by 2030 compared with 2019 levels, according to an analysis by the UN’s climate change secretariat published on 26 October. That is well below the 43 per cent drop needed to meet the 1.5°C temperature target set out in the Paris Agreement.”

The lack of decarbonisation pace is staggering. The World Resources Institute has judged how the world is performing against 40 key actions for meeting the target; NONE are on track. Over half have been judged as ‘well below required pace’, including the critical issue of ‘decreasing the energy intensity of residential and commercial buildings’.

This report, the latest of our BetterWorld series, focuses on the thorny issue of decarbonising commercial units, principally factories and warehouses. Whilst progress has been slow, it makes the case that the industry is beginning to get a handle on improving the efficiency of its units principally due to external pressures. It showcases effective work in the field, whilst also considering the challenges that remain to get all commercial buildings ‘zero carbon ready’ for the industry to effectively contribute to the key economic and social challenge of the age.

The Current Energy Intensity of Commercial Buildings

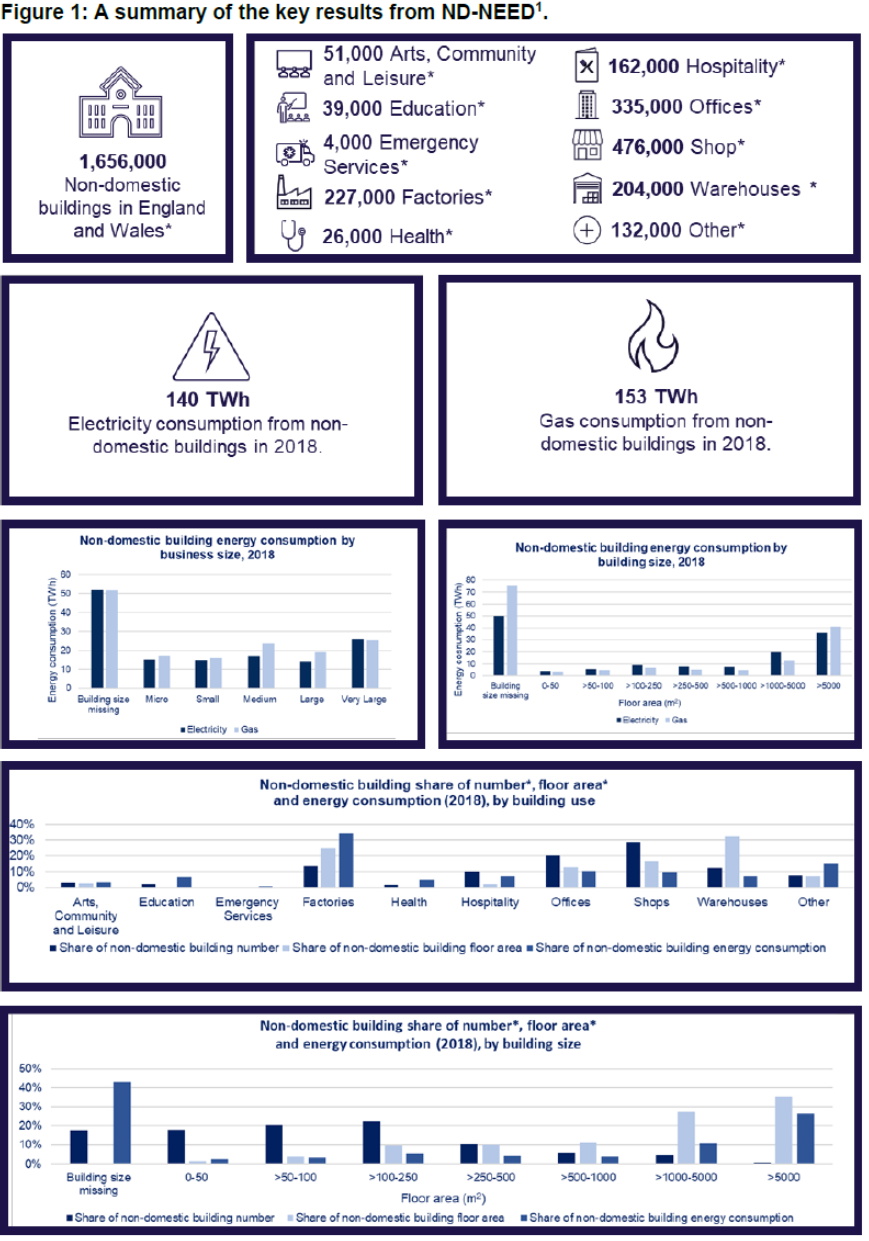

England and Wales’ 1.65m non-domestic buildings consume an incredible 300 TWh of energy per year – forming a key part of the staggering statistic that 43% of UK emissions come from buildings, emphasising Real Estate’s central role in decarbonising the UK economy.

The Valhalla of data for the sector is the ‘Non-domestic National Energy Efficiency Data Framework (ND-NEED)’, which has been providing statistics on the metered energy consumption of non-domestic buildings in England and Wales over the past decade. The fantastic infographic opposite and table below breaks down usage by sector, whilst also showing that nearly 60% of England and Wales’ floor area is within warehouses and factories. This asset class is the focus of this report.

Digging into this data further emphasises how decarbonisation can occur. Typically, the average number of kilowatt-hours per square foot for a commercial building is approximately 22.5 kWh per year; here’s breakdown of how that energy is used:

• Approximately 8 kWh/square foot are consumed by refrigeration and equipment.

• Approximately 7 kWh/square foot are consumed by lighting.

• Approximately 3 kWh/square foot are consumed by cooling equipment.

• Approximately 2 kWh/square foot are consumed by heating equipment.

• Approximately 2 kWh/square foot are consumed by ventilation.

• Approximately 0.5 kWh/square foot are consumed by hot water heating.

With two-thirds of commercial building emissions coming from their composition, taking a ‘fabric-first’ approach to new build and retrofit is essential in reducing energy consumption. The Real Estate sector has historically been slow in improving this base specification -but there is clear evidence that this pace has accelerated in recent months through both an advancement in regulation and the growing demands of funders for the industry to get its house in order (pardon the pun).

The Border to Coast Pension Fund declares its targets

Increasing regulation & growing investor demand

At the centre of UK regulatory efforts is the humble Energy Performance Certificate (EPC). All commercial buildings should have one, with the certificate reflecting the ‘as of today’ position of operational emissions from that unit.

Government demands for improvements in EPC ratings have already begun. By April 2023, every commercial property that is leased needs to have an EPC rated at ‘E’ or above under ‘MEES’ – the Government’s Minimum Energy Efficiency Standard. The Government has also consulted on increasing that threshold to ‘C’ by 2027 and ‘B’ by 2030; in our view, this change is essential to drive pace into decarbonisation.

Border to Coast’s pathway to net zero

At the same point, funders are increasingly demanding improvements in the energy efficiency of their investments. A critical recent example emerged in early November, with the Border-to-Coast Pensions Partnership – one of the UK’s largest Local Government Pension Funds – joining 85 other investors in sharing its targets for the proportion of assets managed in line with achieving net zero by 2050 or sooner as part of the #NetZeroAssetManagers initiative. Their hugely detailed plan, which we recommend reading due to the care and attention that’s been taken in composing it, can be read here – with key charts showing the pace of demanded change on the right-hand side. The implication for the property industry is simple – that Pension Funds like Border to Coast will in future only invest in those companies with clear decarbonisation plans or environmentally efficient assets.

This is undoubtedly forcing the hand of developers and landlords, who are suddenly faced with needing to future-proof or retrofit to either secure the money to build or, as Mitchell Labiak puts it in his recent Investors Chronicle article, ‘avoid being lumped with scores of empty, useless assets.’

Labiak’s article is impressive in succinctly summing up the scale and cost of the challenge. Just consider these two paragraphs:

“Many are struggling. In September, Savills warned that UK retail faced as EPC “cliff edge” with 185 million square feet of space at risk of being unlettable by next year for failing to meet the E-or-above target….a sizeable 35mn sq. ft can be attributed to retail parks, shopping centres and supermarkets which tend to be owned by larger players such as REITs (Real Estate Investment Trusts).

That 35 million figure – which amounts to just over a square mile of space – is just for retail. When you add in the obsolete office and industrial space that could be on the market next year as well as the amount of space that will need to be retrofitted to hit the 2027 and 2030 targets, the sheer scale of the challenge becomes apparent.”

Reducing energy consumption and emissions in practice: Initiatives and Challenges

Can the real estate industry make the changes demanded to be environmentally efficient whilst making returns? At the very least, all developers on the London Stock Exchange and leading privately owned developers are adjusting their business plans to both build efficient new units and to upgrade its present stock – and we showcase key themes here.

Improving new build

Building any new commercial property is an environmental minefield – after all, the ‘greenest building is one that already exists’. According to the World Green Building Council, carbon emissions released before a built asset is used – what is referred to as ‘upfront carbon’ – will be responsible for half of the entire carbon footprint of new construction between now and 2050. It therefore stresses that ‘the built environment sector has a vital role to play in responding to the climate emergency, and addressing upfront carbon is a critical and urgent focus.’ It subsequently issued a bold new vision that:

• By 2030, all new buildings, infrastructure and renovations will have at least 40% less embodied carbon with significant upfront carbon reduction, and all new buildings are net zero operational carbon.

• By 2050, new buildings, infrastructure and renovations will have net zero embodied carbon, and all buildings, including existing buildings must be net zero operational carbon.

This means developers needing to take a fabric first approach – starting with determining how well insulated the building is and analysing ways to reduce energy requirements for heating and power – whilst also forcing them to consider the role of the unit within wider society.

BREEAM’s ten categories

This has resulted in a greater number of buildings that appear to be lower carbon, evidenced by improved EPC ratings (typically ‘A’ or above) and BREEAM ratings of at least ‘very good’; these latter ratings at least attempt to provide a balanced, third-party assessment on the energy performance for a building through providing:

“a holistic sustainability assessment framework, measuring sustainable value in a series of categories and validating this performance with third-party certification. Each of these categories addresses influential factors, including low impact design and carbon emissions reduction; design durability and resilience; adaption to climate change; and ecological value and biodiversity protection.”

Common improvements introduced include:

– The installation of roof-mounted Solar PV’s to reduce reliance on the grid;

– Improving the design, management and system efficiency of new buildings, for example the installation of LED lighting throughout;

– Instigating new waste management policies to divert all waste from landfill;

– Increasing the number of bike stores and Electric Vehicle charging points for both staff and for electric cargo vehicles of all sizes; and

– Improving access to green spaces and the public right of way network to support wellness initiatives for employees.

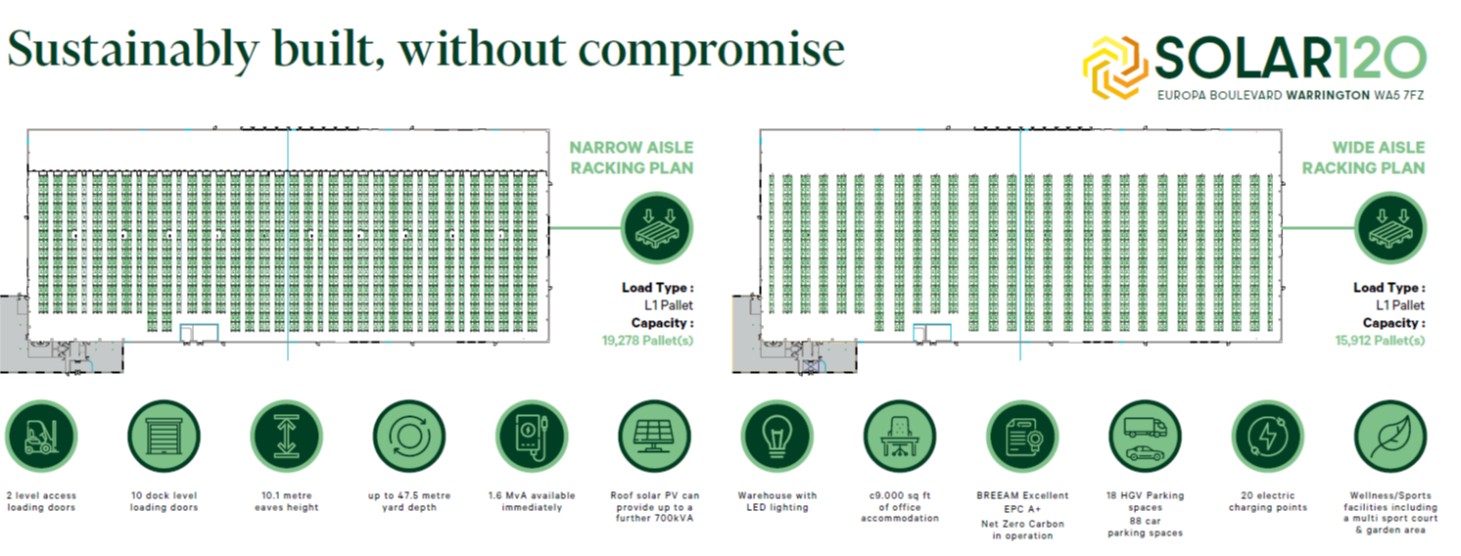

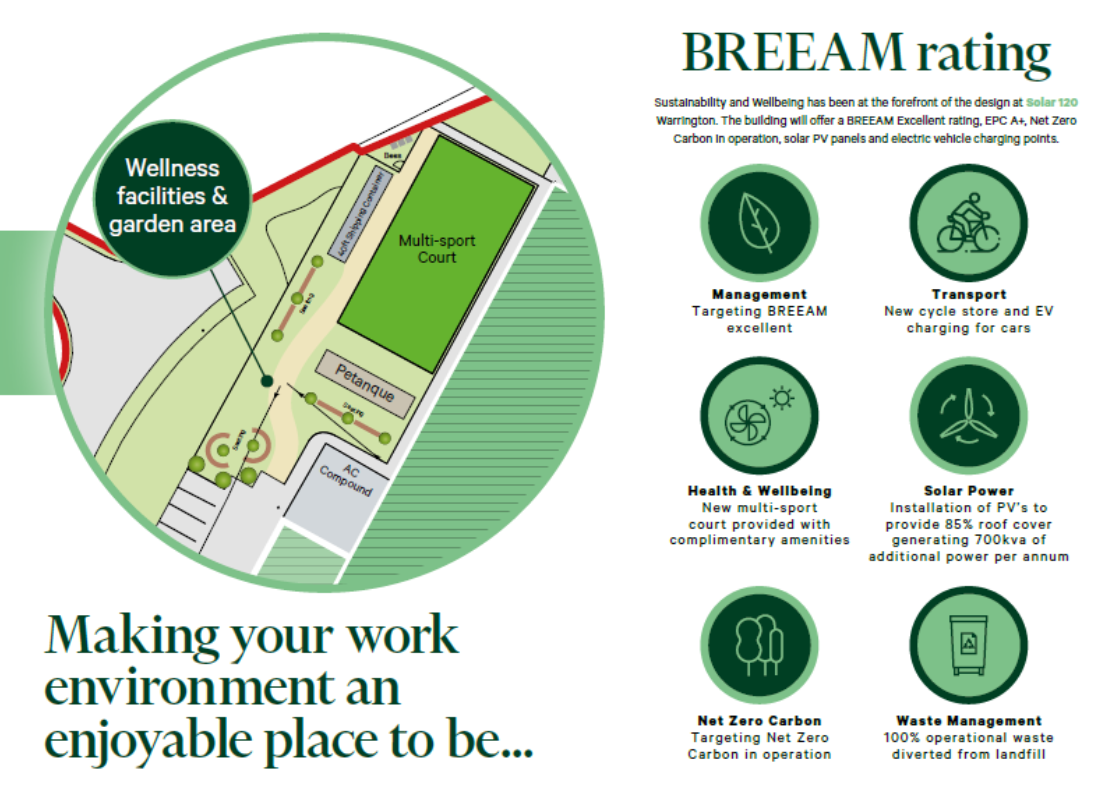

Solar 120’s specification in graphically friendly form

More on Solar 120

An excellent representative example of this new type of unit can be found in my home town of Warrington through a development known as Solar 120, a new 120,000 sq. ft unit close to both Warrington town centre and both the M6 and M62 motorways. Its ‘as of today’ credentials are shown on the graphics above and you’ll note the interesting line ‘targeting net zero carbon in operation’ – more on this later…..

Whilst this improved specification and thoughtfulness carries an extra cost, evidence suggests a ‘green premium’ is actively in play to support this increased expenditure. Mitchell Labiak’s recent Investors Chronicle article pointed to recent efforts by JLL to quantify the extent of this premium, suggesting that more efficient units generated a 7.6% sales premium and a 6% rental premium. At the same point, investors and tenants alike are becoming increasingly educated, and choosy, over where they do business – a topic that will be explored at length on our podcast.

Retrofit: a more difficult task

Retrofitting existing units is a more difficult and contentious task however. Undertaking work in the first place is entirely dependent upon the existing unit’s performance and the attractiveness of its location and ‘offer’, coupled with the financial position of the asset’s owner.

Progress, like that of retrofitting homes, can be described as ‘bitty’. Labiak’s recent article focused on how REITs in the FTSE 350 were getting on with meeting the 2023, 2027 and 2030 targets, revealing that:

“Only nine of the 22 commercial property REITs in the FTSE 350 confirmed they have met the 2023 target, and none have met the 2027 or 2030 targets.”

If this is the position of the best-capitalised businesses in the sector, how do we expect smaller businesses or investors in non-prime markets to fare?

Some of the figures involved are eye-watering. Five well-run property companies have declared that they intend to spend a combined £400m over the next eight years to meet their corporate aims and to remain relevant: Landsec (£135m), Derwent (£97m), Segro (£72m), CLS Holdings (£64m) and Warrington-based Assura (£30m). For the sake of brevity, we shall focus on Segro’s efforts in retrofitting to both showcase what’s being done and the size of the challenge involved.

Segro’s sustainability approach

Segro’s work is based on clearly defined environmental sustainability credentials as part of its desire to be ‘net zero carbon’ by 2030 – guided by ‘above the line’ and ‘below the line’ considerations, as per the graphic on the right-hand side. Its most arresting retrofitting work is in David Brent country, specifically the Slough Trading Estate – Europe’s largest trading estate in a single ownership.

It is currently converting a late 1980s 20,000 sq. ft unit into what it describes as a ‘state-of-the-art, environmentally sustainable industrial and warehouse space’, designed to be net-zero carbon in operation, BREEAM ‘Excellent’ and with EPC A+ rating.

It will include a dazzling array of features which – even more impressively – it has begun to objectively quantify, and worth checking off against other. This includes:

• Smart building sensors to enable energy-efficient operation of the building;

• Photovoltaic panels on the roof which will save 26 tonnes of carbon emissions per year, the equivalent to planting 1,226 trees;

• Energy efficient LED lighting throughout, which will reduce CO2 by 12 tonnes and save around £11,000 per year;

• A 55m² living wall on the front of the building will trap 7,150 grams of dust, extract 126.5 kg of gas and 71.5 kg of particulate matter from the air, and produce around 93.5 kg of oxygen every year;

• Air source heat pump providing heating and comfort cooling;

• Water reducing products throughout e.g., self-closing taps for all wash basins, waterless urinals etc;

• Use of a natural, photocatalytic paint on all wall surfaces that purifies the air through CO2 absorption and reduces ambient odours;

• Electric vehicle charging points;

• Secure bicycle parking with rich biodiverse growing roofs and wildlife habitat panels; and

• Additional bird and bat boxes, beehives and insect habitats to nest and increase pollination across the plot.

Segro’s most recent results explain in further detail how it’s accelerating the retrofit process elsewhere.

Back to finances however. Segro’s work is undoubtedly an expensive business, using its strong balance sheet to undertake works. Others are less fortunate – and we occasionally worry that without a national retrofit programme (in the same way we called for a residential retrofit programme here), there will be a head to the exits for those with assets with poor EPC ratings. This could, in turn, further reduce available commercial space in a market where capacity has become further constrained post-COVID and cause further headaches for regional economies.

This is not a new issue. Back in 2014 Tim Dixon in Estates Gazette was bemoaning the lack of a similar programme and nearly ten years later, we are in the same position. One positive development since that point is the burgeoning influence of the UK Green Building Council, who’ve published high quality foundation guidance that attempts to provide a level of consistency in how retrofitting is approached; read more here.

What will change over the next decade?

Listen to the podcast

Will decarbonisation pace accelerate over the next decade? Can net zero or carbon negative units be achieved in operation? We’re partially convinced on the former but not convinced on the latter; both topics will be explored in more detail on our next BetterWorld podcast on Clubhouse, with four industry leaders, on Monday 21st November from 6pm to 7pm. In the meantime, here’s what we think will happen over the next decade.

• If the current market is left unchecked, we think there will be an increased gap between the haves and have nots – resulting in a green premium for EPC-friendly developers and brown discounts for those with poorly performing assets. Some form of retrofit intervention is essential to ensure a minimum standard and prevent a run on energy-intensive assets, which we believe is only a realistic proposition under a Labour Government.

• A large proportion of the technology that we will come to rely on to either decarbonise buildings or their operations, including off-grid energy technologies, are either in the very early stage of Research & Development or haven’t been invented yet. The real estate industry has to remain both nimble and ready to learn and adopt quickly when it emerges…..

• As operational carbon emissions are reduced, embodied carbon will become an increasingly important consideration for regulators, developers and investors. A consistent carbon policy that sets targets and transparency requirements for new build commercial property will help investors manage risk.

• Regulatory and financial pressure on the industry will only increase. The influence of ESG investing will continue its rise, with investment committee’s placing even greater stock on the environmental performance of potential assets. This is linked to….

• The demand for environmental performance data will exponentially grow to meet the demands of funders, regulators and all tiers of Government. We anticipate growth in data collection services, analytics and standardised reporting channels – a highly valuable (and sustainable!) sub-industry.

We hope you’ve enjoyed reading this report; as ever, get in touch with us to discuss any part of it or to speak to us about any related projects.